In the world of investments, taking risks can sometimes lead to the most rewarding outcomes. For those who thrive on the adrenaline of potentially high returns, today's technology-driven markets offer unprecedented opportunities. Among these, AI trading ideas stand out, powered by platforms like hoopsAI, which revolutionize the way we identify and capitalize on stocks to buy today. This article shines a light on three specific assets for investors seeking excitement and opportunity: GTLB, CQP, and VIV.

Understanding AI Trading Ideas

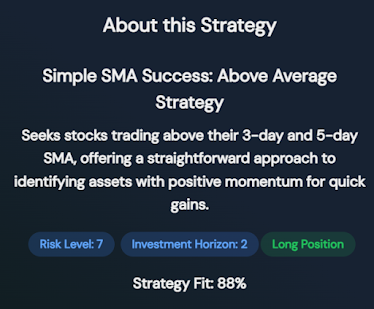

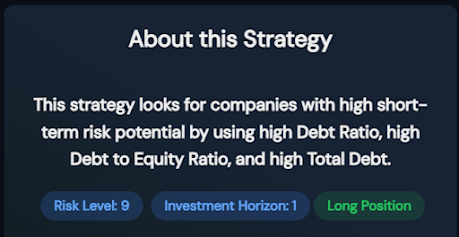

AI trading leverages algorithms and machine learning to analyze vast amounts of data, predict market trends, and uncover hidden investment opportunities. Platforms like hoopsAI have become indispensable tools for investors, providing actionable insights and identifying promising stocks with a level of precision and speed unattainable by human analysts. It's this technology that guides our selection of GTLB, CQP, and VIV as today's top picks for risk lovers.

GitLab Inc. (GTLB) represents a cutting-edge investment in the software development and operations (DevOps) sector. As a platform that enhances collaboration and increases efficiency for software developers, GTLB has shown resilience and growth potential, even in volatile markets. Based on hoopsAI's analysis, GTLB is highlighted for its innovative business model and strong customer base, indicating a promising avenue for investors seeking growth. However, like all investments, it carries risks, notably market competition and technological shifts, which demand investor vigilance.

CQP (Cheniere Energy Partners, L.P.)

Cheniere Energy Partners, L.P. (CQP) is at the forefront of the LNG (liquefied natural gas) export market in the United States. With a robust infrastructure and strategic international contracts, CQP is well-positioned to capitalize on the growing global demand for cleaner energy sources. Insights from hoopsAI suggest that CQP's long-term contracts and expansion plans make it an attractive proposition for investors looking to tap into the energy sector's growth. The primary risk factors include fluctuations in global energy prices and regulatory changes affecting the LNG market.

Telefônica Brasil S.A. (VIV), a leading telecommunications company in Brazil, offers significant growth potential in a rapidly digitalizing world. The company's investment in expanding its 4G and 5G networks, coupled with a broad portfolio of digital services, positions it well for future growth. HoopsAI's analytics underscore VIV's potential for revenue growth and market expansion, making it an intriguing option for investors drawn to the telecom sector's evolution. Investors should consider market competition and regulatory environments as potential risks.

Conclusion

The advent of AI in trading has opened new horizons for investors, offering a glimpse into a future where data-driven decisions pave the way to substantial returns. The assets highlighted—GTLB, CQP, and VIV—each carry their unique blend of opportunities and risks. For those willing to embrace the uncertainty, these investments represent the frontier of today's market possibilities, underpinned by the insightful analysis of hoopsAI. As the landscape of investment continues to evolve, leveraging AI for trading ideas will undoubtedly become a staple for the risk-loving investor.

FAQs

What makes AI trading ideas different from traditional stock picking?

AI trading ideas are derived from the analysis of vast datasets, including market trends, financial news, and economic indicators, processed at speeds and depths beyond human capability. This allows for more precise and timely investment decisions.

How does hoopsAI identify stocks to buy today?

HoopsAI utilizes advanced algorithms that scan and analyze market data in real-time, identifying patterns and trends that suggest potential investment opportunities. It prioritizes stocks based on a variety of factors, including growth potential, market volatility, and sector trends.

What should investors consider before investing in high-risk assets?

Investors should assess their risk tolerance, conduct thorough research, and consider diversifying their portfolio to mitigate potential losses. Consulting with financial advisors and leveraging AI insights, like those from hoopsAI, can also inform better investment decisions.

No comments:

Post a Comment